Most investors interested in natural gas ETFs are familiar with the funds that track natural gas futures contracts. Popular examples include the United States Natural Gas ETF (UNG) and iPath Dow Jones UBS Natural Gas ETN (GAZ).

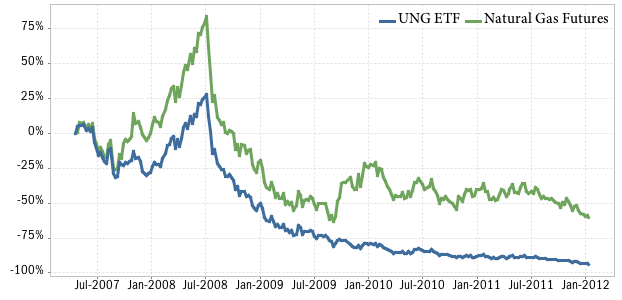

But this is not necessarily the best way to invest in this sector of the commodities markets. The price of natural gas has declined in recent years, and an investor who has bought these funds would be having a tough time, as shown in the historical price chart of UNG below:

Since it started trading in May 2007, the UNG fund has lost 94% of its value. And an investment in GAZ would have fared the same. (The performance of the GAZ fund closely mirrors UNG, although it was launched a few months later in October 2007).

This poor performance is in part due to the price of natural gas futures, which have been in decline since 2008. But that’s not the only reason. As you can see in the graph below, on a percentage basis, the UNG fund has decreased a lot more than the price of natural gas futures, even though it is supposed to track these commodities closely:

That’s not the way an index fund should look when compared to its index; the performance should be virtually identical. Again, we don’t mean to pick on UNG, the GAZ fund performs just as poorly.

Why the huge discrepancy? Why is the ETF price so different from the natural gas futures it is supposed to track? Is it due to the expense ratio of the ETF? That’s part of it. These ETFs have relatively high expense ratios, which will definitely create a drag on the price. In the case of the UNG fund this costs and investor 0.85% per year, and 0.75% for GAZ. But that doesn’t explain the entire difference.

So what else is going on here? In a word: contango. Contango refers to a situation that occasionally happens when futures contracts are rolled over from one month to the next. Since the UNG and GAZ ETFs both hold natural gas futures contracts, they need to roll these contracts forward every month as the old contract expiration date approaches. New contracts sometimes have a slightly higher price than the old one, and this is what is known as contango. Each time the ETF managers roll into a new contract, it costs them a bit more, and these price discrepancies create a huge performance difference over longer periods of time. This is clearly shown in the chart above, where the price of natural gas futures declined 60% during this period. That’s bad, but not nearly as awful as the 93% decline in value of the UNG fund during the same time!

So what is a natural gas investor to do? Fortunately, there is a better way to invest in this commodity.

A better way to invest in natural gas

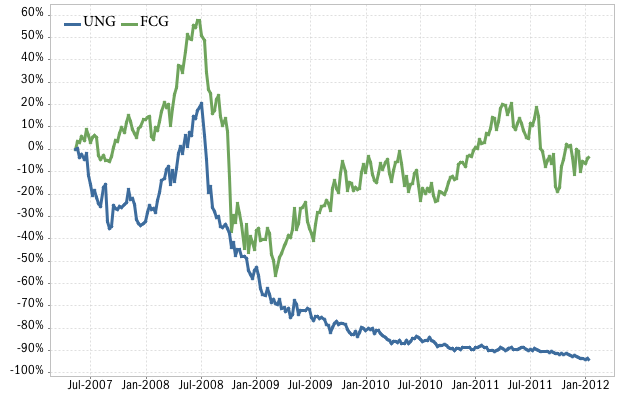

Enter the First Trust ISE-Revere Natural Gas Index Fund (FCG). This ETF has been on the market since May 2007. What’s different about this fund is that it invests in stocks, not futures contracts. More specifically, it aims to track the ISE-REVERE Natural Gas Index, which consists of stocks that derive a substantial part of their revenue from the exploration and production of natural gas. The index includes some household names like ExxonMobil, ConocoPhillips, and Royal Dutch Shell. Sure, these companies engage in oil exploration also, so in that regard, the FCG ETF is not a “pure play” on natural gas. But it sure performs a lot better than the futures based natural gas ETFs. Lets compare the historical performance of FCG against the UNG fund, since inception:

There. Isn’t that better? Since inception, FCG is about at break-even (minus 4%), while UNG has lost 94% of its value. More importantly, FCG has appreciated significantly since the bear market bottom in early 2009, while UNG just continues to decline.

In summary, investors interested in a natural gas ETF should seriously consider the FCG fund, and stay away from futures-based funds like UNG and GAZ. Frankly, I’m a bit puzzled why investors have poured 1.06 billion dollars into UNG (its current assets under management), whereas FCG has attracted a relatively modest $354 million. And if you’re looking for a natural gas pure play, stick to the actual futures contracts.