Commodity index funds purchase futures contracts to track the price of a broad basket of commodities. There are currently more than 10 exchange traded funds of this kind. Each fund tracks a different underlying index, and the specific commodities and weights vary significantly. In this post, I’ll take a closer look at the top four commodity index funds, ranked by total assets under management:

- PowerShares DB Commodity Index Tracking ETF (DBC)

- iPath Dow Jones UBS Commodity Index ETN (DJP)

- iShares S&P GSCI Commodity-Indexed Trust ETF (GSG)

- Elements Rogers International Commodity Index ETN (RJI)

Index Weights

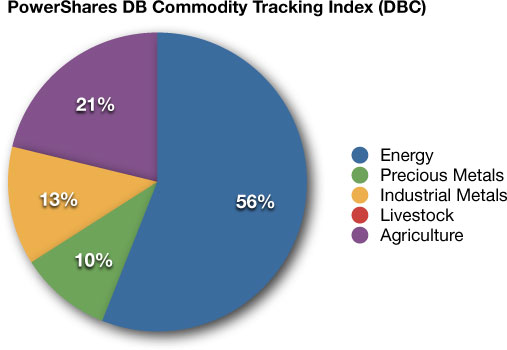

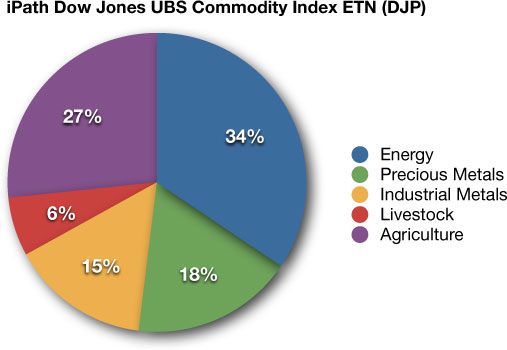

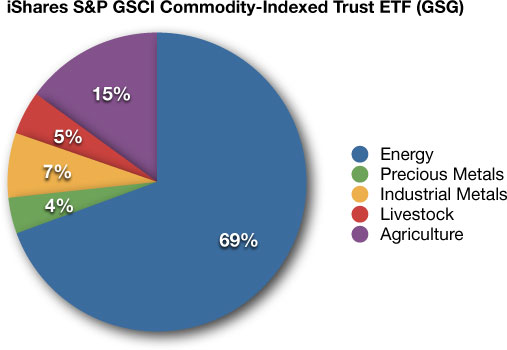

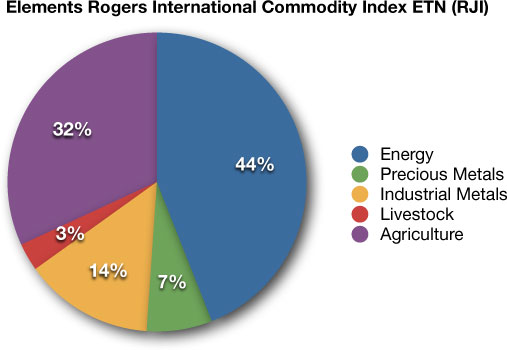

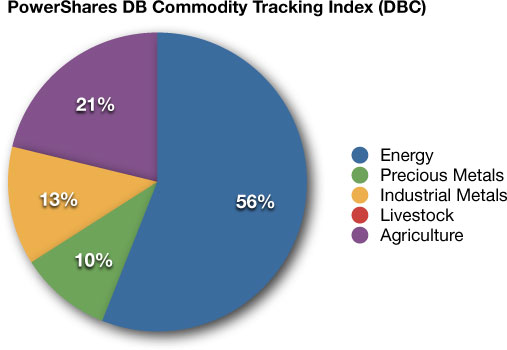

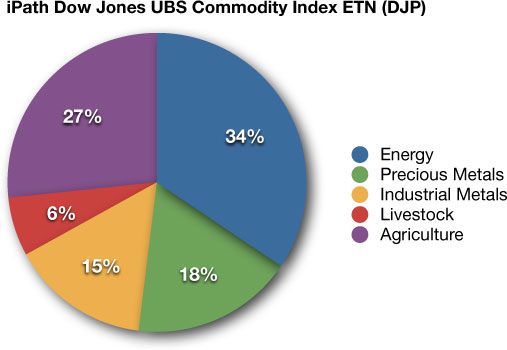

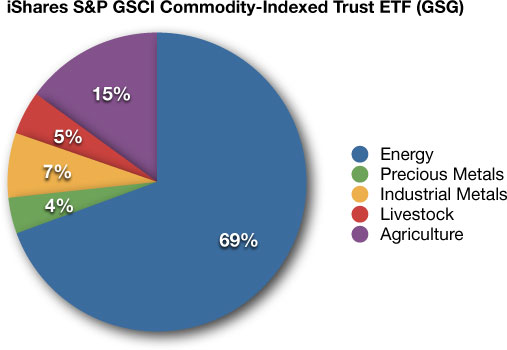

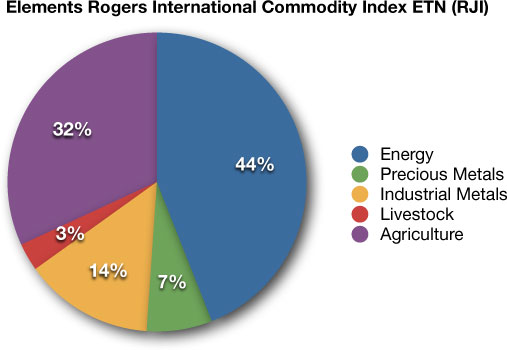

When analyzing a commodity index fund, it helps to group its holdings into five major categories: Energy, Precious Metals, Industrial Metals, Livestock, and Agriculture. While all these funds track a broad basket of commodities, their composition varies significantly. The table below shows these differences, by looking at the percentages allocated to each major commodity category:

Percentage Allocation /

Commodity Category |

DBC

[details] |

DJP

[details] |

GSG

[details] |

RJI

[details] |

| Energy |

56.00% |

34.42% |

69.40% |

44.00% |

| Precious Metals |

9.94% |

17.53% |

3.90% |

7.10% |

| Industrial Metals |

12.84% |

15.02% |

7.00% |

14.00% |

| Livestock |

0.00% |

6.37% |

4.70% |

3.00% |

| Agriculture |

21.20% |

26.66% |

15.00% |

31.90% |

Understanding the difference in these index weights can help you make a better investment decision. For example, investors in GSG and DBC should not be surprised that their ETF price is heavily influenced by the price of oil and gas commodities (comprising 69% of GSG and 56% of DBC). DBC doesn’t track Livestock commodities at all, whereas the other funds allocate as much as 6.4% to this category. GSG has a relatively small 3.9% allocation to precious metals, compared to 17.5% for DJP. Rogers RJI allocates almost 32% to agricultural commodities, more than double GSG’s 15% allocation in this category.

Individual Commodities Tracked

The funds also differ significantly with respect to the individual commodities they track. DBC tracks the fewest commodities (14), while RJI tracks the broadest basket (36). Investors seeking the broadest and most balanced commodity basket may be best served with RJI or DJP, whereas investors who care more about the relative importance of each commodity (as tracked by futures trading volume) should stick to one of the other ETFs.

The table below shows the detailed composition of each fund:

Percentage Allocation /

Commodity |

DBC

[details] |

DJP

[details] |

GSG

[details] |

RJI

[details] |

| Brent Oil |

12.41% |

|

16.70% |

14.00% |

| Crude Oil |

13.41% |

16.93% |

32.70% |

21.00% |

| Heating Oil |

12.56% |

4.42% |

5.40% |

1.80% |

| RBOB Gasoline |

12.34% |

3.76% |

4.60% |

3.00% |

| Natural Gas |

5.28% |

9.31% |

2.80% |

3.00% |

| Gas Oil |

|

|

7.20% |

1.20% |

| Gold |

8.02% |

13.72% |

3.35% |

3.00% |

| Silver |

1.92% |

3.81% |

0.55% |

2.00% |

| Platinum |

|

|

|

1.80% |

| Palladium |

|

|

|

0.30% |

| Copper |

4.32% |

6.41% |

3.30% |

4.00% |

| Aluminum |

4.17% |

4.50% |

2.20% |

4.00% |

| Zinc |

4.35% |

2.47% |

0.50% |

2.00% |

| Nickel |

|

1.65% |

0.60% |

1.00% |

| Lead |

|

|

0.40% |

2.00% |

| Tin |

|

|

|

1.00% |

| Live Cattle |

|

4.00% |

2.70% |

2.00% |

| Feeder Cattle |

|

|

0.50% |

|

| Lean Hogs |

|

2.36% |

1.50% |

1.00% |

| Corn |

5.22% |

7.25% |

4.50% |

4.75% |

| Soybeans |

5.50% |

6.64% |

2.30% |

3.35% |

| Soybean Oil |

|

2.61% |

|

2.17% |

| Soybean Meal |

|

|

|

0.75% |

| Canola |

|

|

|

0.67% |

| Sugar |

5.29% |

2.68% |

2.20% |

2.00% |

| Wheat |

5.19% |

3.69% |

2.80% |

7.00% |

| Kansas Wheat |

|

|

0.70% |

|

| Barley |

|

|

|

0.10% |

| Oats |

|

|

|

0.50% |

| Rice |

|

|

|

0.50% |

| Coffee |

|

2.47% |

0.90% |

2.00% |

| Cocoa |

|

|

0.30% |

1.00% |

| Orange Juice |

|

|

|

0.66% |

| Azuki Beans |

|

|

|

0.15% |

| Cotton |

|

1.33% |

1.30% |

4.20% |

| Lumber |

|

|

|

1.00% |

| Rubber |

|

|

|

1.00% |

| Greasy Wool |

|

|

|

0.10% |

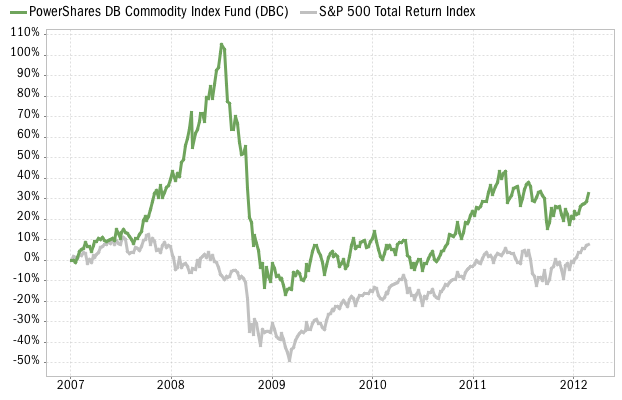

PowerShares DB Commodity Index Tracking ETF (DBC)

This fund tracks the Deutsche Bank Optimum Yield Diversified Commodity Index Excess Return. It holds futures contracts on 14 of the most heavily-traded and important physical commodities in the world: Brent Crude, Light Crude, Heating Oil, RBOB Gasoline, Natural Gas, Gold, Silver, Copper – Grade A, Aluminum, Zinc, Corn, Soybeans, Sugar # 11, and Wheat. With over 5.5 billion U.S. dollars under management, it’s the most widely held commodity index fund. It started trading in February 2006, making it the first available commodity index fund. The chart below shows the percentage allocation to each commodity:

iPath Dow Jones UBS Commodity Index ETN (DJP)

This ETN replicates the performance of the Dow Jones-UBS Commodity Index Total Return. It holds futures contracts for 19 different commodities: Crude Oil, Heating Oil, Unleaded Gas, Natural Gas, Gold, Silver, Copper, Aluminum, Zinc, Nickel, Live Cattle, Lean Hogs, Corn, Soybeans, Soybean Oil, Sugar, Wheat, Coffee, and Cotton. DJP was first made available to investors in July 2006. The chart below shows the percentage allocation to each commodity:

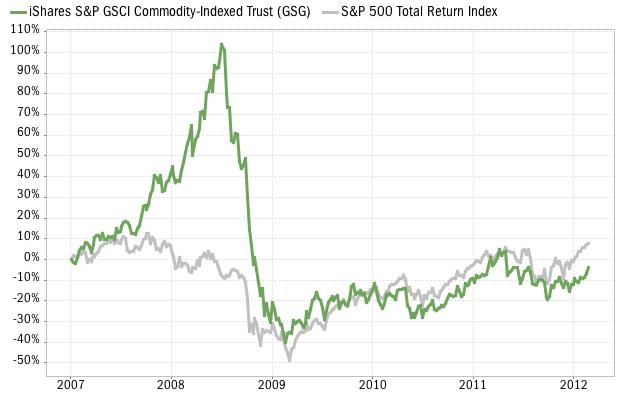

iShares S&P GSCI Commodity-Indexed Trust ETF (GSG)

This fund tracks Standard & Poor’s GSCI index (formerly the Goldman Sachs Commodity Index). Unlike the other commodity ETFs, the GSCI is a tradable index (on the Chicago Mercantile Exchange), so this fund simply purchases CME futures contracts on this index (as well as the appropriate cash/bond balance to achieve 1x leverage). The GSCI index contains 24 commodities: Brent Crude, Crude Oil, Heating Oil, Unleaded Gasoline, Natural Gas, Gas Oil, Gold, Silver, Copper, Aluminum, Zinc, Nickel, Lead, Live Cattle, Feeder Cattle, Lean Hogs, Corn, Soybeans, Sugar, Wheat, Kansas Wheat, Coffee, Cocoa, and Cotton. The GSG fund started trading in October 2006. The chart below shows the percentage allocation to each commodity in the current index:

Elements Rogers International Commodity Index ETN (RJI)

This ETN tracks the Rogers International Commodity Index (RICI), which consists of 38 different exchange-traded physical commodities, although the ETN currently only tracks 36: Brent Oil, Crude Oil, Heating Oil, RBOB Gasoline, Natural Gas, Gas Oil, Gold, Silver, Platinum, Palladium, Copper, Aluminum, Zinc, Nickel, Lead, Tin, Live Cattle, Lean Hogs, Corn, Soybeans, Soybean Oil, Soybean Meal, Canola, Sugar, Wheat, Barley, Oats, Rice, Coffee, Cocoa, Orange Juice, Azuki Beans, Cotton, Lumber, Rubber, and Greasy Wool. Two commodities (Milling Wheat and Rapeseed) are in the RICI but not tracked by the ETN (although these two only represent 1.25% of the index). The index was designed in the late 1990s by James (Jim) B. Rogers. The RJI fund was listed in October 2007. The chart below shows the percentage allocation to each commodity:

Other Commodity Index Funds

While the four funds featured above are the most popular, they are not the only commodity ETFs that track broad baskets of commodities. Alternatives include:

- GreenHaven Continuous Commodity Index Fund (GCC)

- United States Commodity Index Fund (USCI)

- ETRACS UBS Bloomberg Constant Maturity Commodity Index ETN (UCI)

- Goldman Sachs Connect GSCI ETN (GSC)

- ETRACS UBS DJ-UBS Commodity Index ETN (DJCI)

- PowerShares DB Commodity Long ETN (DPU)